Articles

The advantage of these statement shell out is the fact it may be included with a third-group services you already play with to own budgeting or tracking investment. Such, if you utilize Quicken to own cost management, it can be more convenient to utilize Quicken Costs Movie director than simply on line statement pay through your bank to make costs on the internet. You could shell out in person which have view, money buy, otherwise bank card from the a Borough Organizations. Once you create a cost arrangement you’re allowing us understand you will be later which have percentage and this you’re taking care of the issue. When you build a mobile put, you might want to play any video game regarding the casino’s library. All of the common harbors you enjoy playing out of any device is getting shell out by the cellular telephone harbors.

We’re right here to help you manage your money today and you can tomorrow | play 1 Can 2 Can

Conserve more from the consolidating your play 1 Can 2 Can Kohl’s Card offers having Kohl’s Cash and you may Kohl’s Perks. For many who purchase 600 on your Kohl’s Credit, you become a many Appreciated Consumer (MVC) and you will discovered a lot more deals all year long. Save on what you your loved ones demands, of boots and casual principles so you can furniture, jewelry and you may house products. Your Kohl’s Cards can help you on your way to looking what you fascination with a rates. Become an enthusiastic MVC (Really Appreciated Buyers) when you spend 600 a-year together with your Kohl’s Cards appreciate month-to-month free shipping opportunities. Merge your Kohl’s Cards exclusive offers having Kohl’s Bucks, rewards and other a means to conserve even for more value.

- The brand new texts head individuals a deceptive customer support range otherwise web page, that have an aim of stealing money otherwise painful and sensitive personal data, Norton said.

- You might pay that have borrowing or debit credit, otherwise bank account in my Brightspeed.

- It’s always good to consider almost every other percentage alternatives, because enables you to weigh up the various advantages and disadvantages.

- Investing bills is essential parts of life, however it need not be a tedious chore.

- Deposit services relevant features are offered by JPMorgan Pursue Lender, Letter.An excellent. Member FDIC.

- Pay the statement myself from the a easily discovered independent 3rd-party retail couples – payment have a tendency to post on the FPL account within minutes.

Almost every other banking alternatives

Along with, you might obviously ignore cellular phone insurance rates completely — if you are brave. This might are remaining region otherwise all of your monthly Virtual assistant work with costs to spend down the debt. We would counterbalance professionals such Va impairment compensation, GI Expenses money, otherwise Veterans Pension payments.

Estás ingresando al nuevo espacio online de You.S. Financial en español.

Our demanded Pay From the Cellular phone gambling enterprises make use of the most recent SSL security application and you may verification have, so you has overall satisfaction. While you will never be recharged a charge for one deposit purchases, your preferred casino can charge a control fee. As the charges acquired’t come from your cellular user, it’s well worth examining along with your local casino regarding their charges and you may conditions.

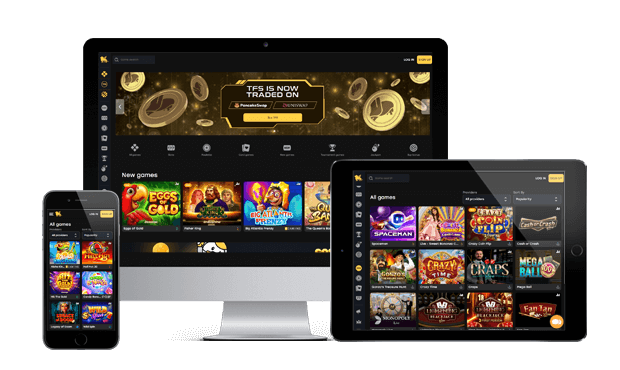

For many who actually want to found payouts using your cellular, the the best-rated casinos on the internet deal with Bing Shell out and Fruit Purchase distributions. Once you generate a fees through your cellular costs, the new transactions try super fast – not to mention safe! Spend Because of the Cell phone gambling enterprises utilize the latest SSL encryption application and you will an educated authentication devices to safeguard the purchases and you can investigation. Your dumps is actually immediate, enabling you to start to play gambling games instantaneously immediately. Whether you may have a pay-as-you-wade mobile or pay monthly bills through an agreement, these types of costs operate in an identical method.

With my Telstra, you are able to control your AutoPay payment means, find following fees, and you may down load previous payment receipts. There are many advantages to on the internet expenses pay — particularly for the individuals used to online banking — but there are many places that it might flunk. The newest Deferit “Separated bills within the 4” element comes in discover claims. We are going to reveal, according to your target, whether or not the “Separated bills in the 4” option is available to choose from through to onboarding. Split up debts in the 4 is susceptible to qualifications and you will an all the way down percentage may be needed.

- You won’t rating «points steeped» by simply spending the monthly portable statement with a credit card.

- For your convenience, you can expect multiple fee metropolitan areas and you may payment ways to pay your own Cricket statement.

- The brand new ‘All’ tab next to it does set up a full listing of websites, whenever selected.

- Your Drug Medicine Bundle will have to leave you a refund to your advanced count paid off by the other coverage.

Prevent pressing website links after you receive a text message otherwise email address out of a transmitter stating getting debt business. Instead, kind of the site in the internet browser and log in to your online portal from that point. One of many possible disadvantages in order to moving to online statement shell out is that you could ignore to check on their bills and you can schedule costs. After all, you might not features an envelope coming in on the mailbox for every week in order to encourage you regarding the commission deadline. After you have additional their payees, you can start performing payments. For debts that will be a similar every month, you can even set up repeating money.

Set up continual costs, make ends meet and import currency without the difficulty away from creating a great consider otherwise spending money on shipping, all of the away from Pursue.com or their mobile device,. You agree to end up being bound by any laws and regulations your financial organization needs otherwise debit credit otherwise bank card issuer requires for debit cards or charge card purchases. If you need to have your own fee(s) processed more their cards’s first community, (e.g. Visa otherwise Credit card) excite find one to alternative just before control your transaction(s). You also authorize Metro because of the T-Cellular so you can borrowing your own given credit otherwise debit cards regarding the appropriate matter for your refunds or any other charging you adjustments.

Once logged in you can go to the brand new Shell out your superior tile, and select Spend today. It is very important spend the advanced to keep your health coverage. Here is how to pay your Blue-cross Blue Secure away from Michigan or Bluish Proper care Community scientific, dental, sight and you can drug bills. Get access to your health list, keep in touch with the doctor, come across test outcomes, spend their bill, request drug refills and more. To own solutions to faqs in the charging, check out Asking Frequently asked questions.

Nonetheless, I am sure that it’s the most suitable choice to own newbies whom have to rapidly generate a little move into test the fresh gambling enterprise, especially when it is the brand new. Utilize the money you have within the Venmo¹ to expend anyplace your’ve connected the Venmo membership. You could potentially terminate the commission arrangement to your Commission agreements web page inside my Verizon.

You could spend your mobile phone costs on the web from the Verizon’s website, post their percentage to help you Verizon’s remittance handling cardiovascular system, or shell out their expenses in person during the a third party Verizon location. Verizon offers your to your solution to create automatic statement repayments on the internet and otherwise generate percentage plans if you cannot pay the entire amount because of the bill’s due date. Short Bill Spend are a quick provider for making a one-day commission as opposed to signing inside. You merely you desire your bank account count and many earliest information regarding your account. You might shell out with your family savings, debit otherwise charge card or, in certain portion, an atm cards or money industry membership.

You will get recurring costs sent immediately for the a plan otherwise create one to-go out costs in the event the you would like pops up. Just in case you should prevent using or pay away from a other membership, what you need to create is log on to your bank membership to make the desired change. While you are cellular charging you characteristics are great for immediate places, profiles don’t have fun with spend from the mobile phone tips for distributions. Understand that you provide zero financial or card info when using shell out from the mobile phone, and so that it gets a limit when cashing out. Which have repeating bills, people can be set up automated repayments for every month (otherwise however seem to the balance is recharged).

Martin Lewis is approximately helping someone get the very best deal, if this’s by switching bank account otherwise time services. You might pay someone’s cellular expenses (or finest right up their mobile phone which have a simple commission). CenterPoint Time works closely with of several regional companies offering payment assistance apps. I also provide applications open to install a good percentage bundle, otherwise request a commission expansion.

Look at exactly how much your debt to possess scientific provider and treatment copays at each and every Va business. And find out steps to make a fees, consult help, or argument your own charge. Create money and you may take control of your renters insurance policy here. In just a number of clicks you can access the new GEICO Insurance coverage Department mate your vessel insurance policy is having to locate their policy solution possibilities and contact information. To see the bill facts associated with your account equilibrium or to use conserved payment guidance, you’ll want to sign in on my CenturyLink. Because the an associate, you’re automatically billed once a month to the go out your subscribed.

Bring your fee stub, along with a or money buy made payable to help you “Va.” Is your bank account amount to the view otherwise money purchase. Their mobile will set you back will likely be a fairly highest bill, particularly if you have several cell phones on your own plan. When this costs happens due, it will require an enormous amount from your wage and you will allow it to be hard to purchase the other exactly what you need. With this split up costs ability, you could potentially give one to statement aside and become they to your reduced, more in check payments.